1. Trading hours

1.1. Board Lot/ Odd-lot Trading

|

Session |

Trading method |

Time |

Applicable orders |

|

Morning |

ATO periodic call auction |

9:00 - 9:15 |

ATO, LO |

|

Continuous trading |

9:15 - 11:30 |

LO, MTL |

|

|

Break |

11h30 - 13h00 |

|

|

|

Afternoon |

Continuous trading |

13:00 - 14:30 |

LO, MTL |

|

ATC periodic call auction |

14:30 - 14:45 |

ATC, LO |

|

For odd-lot orders, only Limit Orders (LO) are allowed in all trading sessions.

Note: Odd-lot orders must not be placed for newly listed stocks, fund certificates, or covered warrants, or for those resuming trading after a suspension or halt of 25 consecutive trading days or more, until a price has been established through traded board lot orders.

1.2 Board Lot/ Odd-lot Put-through Trading

|

Session |

Trading method |

Time |

Applicable orders |

|

Morning |

Put-through during trading hours |

9:00 - 11:30 |

Put-through order, indicative order |

|

Break |

11h30 - 13h00 |

|

|

|

Afternoon |

Put-through during trading hours |

13:00 - 14:45 |

Put-through order, indicative order |

|

Put-through after trading hours |

14:45 – 15:00 |

Put-through order, indicative order |

|

1.3 Trading of restricted securities

Restricted securities are traded during the ATO periodic call auction (PCA) session, multiple periodic call auctions (each lasting 15 minutes from 9:15 to 14:30) and ATC PCA session.

|

Session |

Trading method |

Time |

Applicable orders |

|

Morning |

ATO periodic call auction |

9:00 - 9:15 |

ATO, LO |

|

Multiple periodic call auctions (each lasting 15 minutes) |

9:15 - 9:30 9:30 – 9:45 … 11:15 – 11:30 |

LO |

|

|

Break |

11h30 – 13h00 |

|

|

|

Afternoon |

Multiple periodic call auctions (each lasting 15 minutes) |

13:00 - 13:15 13:15 – 13:30 … 14:15 – 14:30 |

LO |

|

ATC periodic call auction |

14:30 - 14:45 |

ATC, LO |

|

2. Trading orders

a. An ATO (At the Opening) Order is a buy or sell order that is recorded in the trading system with its order price determined according to the following principles:

- If there are only ATO orders in the order book:

+ The price is set at the reference price if the order book contains only ATO Buy orders or only ATO Sell orders or if the total Buy volume equals the total Sell volume.

+ The price is set at one tick size above the reference price if the total Buy volume exceeds the total Sell volume. If this calculated price exceeds the ceiling price (upper limit), it is adjusted to the ceiling price.

+ The price is set at one tick below the reference price if the total Sell volume exceeds the total Buy volume. If this calculated price is below the floor price, it is adjusted to the floor price.

- If there are limit orders (LO) in the order book:

+ The price of an ATO Buy order is determined as the highest of the following three prices: The highest Buy price plus one tick (capped at the ceiling price if it exceeds the ceiling), the highest opposing Sell price, and the reference price.

+ The price of an ATO Sell order is determined as the lowest of the following three prices: The lowest Sell price minus one tick size (if this price is lower than the floor price, it is the floor price), the lowest opposing Buy price, and the reference price.

ATO orders are not given priority over earlier-placed LO Buy orders at the ceiling price or LO Sell orders at the floor price when orders are matched.

After the ATO price discovery period, any untraded ATO orders or the remaining part of partially traded ATO orders are automatically cancelled.

b. Limit Order (LO):

A Limit Order (LO) is a buy or sell order placed at a determined price or better. An LO shall be effective as from the time it is entered into the trading system until the close of the trading day or until the rescission of the order

The LO order are allowed to be entered into the trading system during both continuous trading and periodic call auction sessions.

For odd-lot trading, only LO orders are accepted.

c. Market to Limit (MTL) Order

An MTL order is a Buy order placed at the lowest available Sell price or a Sell order placed at the highest available Buy price on the market.

Matching principles:

- As being entered into the trading system, an MTL Buy order is immediately matched at the lowest available Sell price, and an MTL Sell order is matched at the highest available Buy price.

- If the MTL order is not fully filled after matching at the initial price level, the remaining quantity of the order will continue to be matched at the next best available Sell (for Buy orders) or Buy (for Sell orders) price.

If the remaining quantity cannot be matched further due to the absence of counterparty quantity, the MTL Buy order will be converted into an LO order with one tick size above the last traded price and the MTL Sell order will be converted into an LO order with one tick size below the last traded price.

Characteristics:

+ The MTL order is only valid during continuous trading sessions.

+ The MTL order is automatically cancelled if there is no counterparty limit order available when it enters the system.

+ Compared to LO orders, the MTL order is likely to be executed more quickly because they are matched immediately upon entry.

+ Once converted into an LO order, the MTL order is subject to follow applicable rules on LO order modification and cancellation.

d. At the Close (ATC) Order

Similar to the ATO order, the ATC order is applied during the periodic call auction session used to determine the closing price.

After the ATC period, any unexecuted ATC orders or partially traded orders will expire and become invalid.

e. Displayed prices of ATO/ATC orders

- If there are only untraded ATO/ATC Buy/Sell orders: The displayed price of ATO/ATC orders is the projected traded price. If no projected traded price is available, the displayed price will be the last traded price, or the reference price if the last traded price is unavailable.

If there are untraded LO Buy/Sell orders:

+ The displayed price of an ATO/ATC Buy order is the highest bid price plus one tick size (if this calculated price exceeds the ceiling price, the displayed price is the ceiling price).

+ The displayed price of an ATO/ATC Sell order is the lowest ask price minus one tick (if this calculated price is below the floor price, the displayed price is the floor price).

3. Principles of order matching

3.1. Price priority

- The Buy order of higher price shall take precedence;

- The Sell order of lower price shall take precedence.

3.2. Time priority

Where multiple Sell or Buy orders are of the same price, the order that is first entered into the trading system shall take precedence

4. Order matching methods and trade price determination

4.1. Periodic call auction

This is a trading method executed by the trading system on the basis of matching securities buying and selling orders at a specific time. The principles of determining the executed price are as follows:

a) The executed price at which the maximum trading volume is reached and all Buy orders with higher prices and Sell orders with lower prices than the selected price must be exercised.

b) In case there are many price levels satisfying Condition (a), the selected price is the price at which the orders of one party must be fully exercised, the orders of the counter party must be exercised fully or partially.

c) In case there are many price levels satisfying Condition (b), the selected price is the price that is the same or close to the last traded price according to order matching method.

d) In case there is no price satisfying Condition (b), the selected price is the price that satisfies Condition (a) and coincides with or is close to the last traded price according to order matching method.

4.2 Continuous trading

This is a trading method in which Buy and Sell orders are matched immediately as they are entered into the trading system.

Price matching principle: The traded price is the price of the counterparty order already available in the order book.

5. Put-through trading

- Put-through trading is performed on the principle that the buyer and seller enter their orders into the system and the counterparty confirms the negotiated transaction.

- Put-through trading is not allowed on the first trading date of newly listed stocks, closed-end fund certificates and covered warrants, or for securities that have been suspended from trading for 25 or more consecutive trading days, until a price is established through the matching of standard board-lot orders.

6. Order modification/cancellation

6.1 Order-matching trading method

- During continuous trading session: An LO order can be modified its price and quantity but cannot modified both its price and quantity at the same time. It can be canceled during the trading time. The order of priority of such modified order is determined as follows.

- Precedence is unchanged if the quantity is reduced.

- Precedence is applied since the order is entered into the system if the quantity is increased and/or the price is changed.

- During ATO/ATC sessions: Orders cannot be canceled or modified during these sessions, including orders carried over from continuous trading sessions.

- During periodic call auction (PCA) sessions: Orders cannot be canceled or modified during the last 5 minutes of each PCA session.

6.2. Put-through trading

Confirmed negotiated transactions cannot be canceled or modified during trading hours.

7. Trading unit and tick size

7.1 Trading unit

- Board lot trading:

+ A multiple of 100 share units, closed-end fund certificates, ETF certificates and warrants

- The maximum volume of a board-lot order placed cannot exceed 500,000 shares, closed-end fund certificates, ETF funds and warrants

- Odd-lot trading:

+ Trade unit: 1 share, closed-end fund certificate, ETF certificate and warrant

+ Quantity per order: 1-99 shares, closed-end fund certificates, ETF certificates and warrants

- Put-through trading:

+ Trading unit: No fixed trading unit is applied.

+ Trading quantity:

Board lot: From 20,000 shares, closed-end fund certificates, ETF certificates and warrants on wards

Odd lot: 1 - 99 shares, closed-end fund certificates, ETF certificates and warrants

7.2 Tick size

- Order-matching method:

| Price range (VND) | Tick size (VND) |

| <= 10,000 | 10 |

| 10,000 - 49,950 | 50 |

| >= 50,000 | 100 |

- For ETF certificates and warrants: A tick size of VND10 is applied to all price ranges

- Tick size is not applied to bond trading.

8. Trading band (collar)

- Trading band for a stock in a trading date is 7% to the either side of the reference price of share/fund certificate

- Trading band for a stock on its ex-rights date in the case of treasury share offerings to existing shareholders is 7% to the either side of the reference price of share/fund certificate.

- Trading band of ±20% is applied to the following cases:

+ The first trading date of a newly-listed stock, closed-end fund certificate and ETF certificate

+ The resumed trading date of a stock, closed-end fund certificate and ETF certificate suspended for trading in 25 or more consecutive trading days.

+ On the ex-rights date when dividends/bonuses are paid in treasury shares to existing shareholders;

+ When the cash dividend amount is greater than or equal to the closing price of the trading day preceding the ex-rights date;

+ On the first trading day of a split listed company.

9. Ceiling price and floor price determination

9.1 Stock, closed-end fund certificate and ETF fund certificate:

Ceiling price = Reference price + (Reference price * Trading band)

Floor price = Reference price - (Reference price * Trading band)

Where the ceiling price (upper limit) or the floor price (lower limit) is equal to the reference price, the ceiling price and the floor price will be adjusted as follows

Adjusted ceiling price = Reference price + a tick size of price.

Adjusted floor price = Reference price -a tick size of price

Where the above adjusted ceiling price and floor is less than or equal to zero, the floor price will be the reference price.

Where the adjusted reference price is equal to a tick size, the ceiling price will be determined as follows

Adjusted ceiling price = Reference price + a tick size of price

Adjusted floor price = Reference price

9.2 Call warrant

The ceiling/floor prices for the first trading date and regular trading dates of a call warrant based on underlying stocks are determined as follows

Ceiling price = Reference price of the warrant + (Ceiling price of the underlying stock - Reference price of the underlying stock) * 1/Conversion ratio

Floor Price = Reference price of the warrant - (Reference price of the underlying stock - Floor price of the underlying stock) * 1/Conversion ratio

Where the adjusted floor of a warrant is less than or equal to zero, the floor price will be set to the smallest tick size

10. Reference price determination

10.1 Stock, closed-end fund certificate and ETF fund certificate

- The reference price of a stock, closed-end fund certificate and ETF fund certificate is the closing price from the last trading day (i.e., the last traded price on the latest trading day).

- The reference price of a newly listed stock, closed-end fund certificate and ETF certificate on their first trading date:

+ The reference price is proposed by the listing organization, the fund management company and the listing advisory organization (if applicable).

+ If the reference price cannot be determined for three consecutive trading days from the first trading day, the listing organization, fund management company and advisory organization must re-determine such reference price.

- On the ex-rights date (e.g., dividend or rights distribution), the reference price is the closing price from the last trading date, adjusted for the value of dividends or rights distributed, except in the following cases:

+ The issuer offers new shares or fund certificates at a price equal to or higher than the adjusted closing price of the last trading date immediately preceding the ex-rights date (if applicable)

+ The issuer pays cash dividend with a value equal to or greater than the closing price on the day immediately preceding the ex-rights date.

+ The issue pays dividends or bonuses in treasury shares to existing shareholders.

- For the stock, closed-end fund certificate and ETF certificates suspended from trading for more than 25 sessions, the reference price upon resumption of trading is determined by the Stock Exchange.

10.2 Call warrant

Reference price of a warrant = Issuing price of warrant *(Reference price of the underlying stock on the first trading date of warrant/Reference price of the underlying stock on the announcement date of warrant issue) * (conversion ratio on the announcement date of warrant issue /Conversion ratio on the first trading date)

- Where the trading is suspended for 25 trading days or more, the reference price of call warrant is determined as follows: Reference price of a warrant = Closing price of warrant on the trading day preceding the trading suspension day *(Reference price of the underlying stock on the first trading date of warrant after trading resumes/Reference price of the underlying stock on the date preceding the trading suspension date) * (Conversion ratio on the date preceding the trading suspension date /Conversion ratio on the first date the warrant resumes trading)

11. Foreign investor trading

a) Order-matching trading

- The Buy volume of shares and closed-end fund certificates of foreign investors will result in a decrease in the foreign ownership room (currently purchasable volume) immediately after the Buy order is entered into the system.

- The Sell volume of foreign investors will result in an increase in the current foreign room after the settlement of the transaction is made.

- A Buy order placed by a foreign investor will not be accepted by the system if the current foreign room is less than the order quantity.

- If a Buy order is amended to reduce the quantity, the current foreign room will increase by the reduced quantity immediately after the amended order is entered into the system.

- If a Buy order is amended to increase the volume, the current foreign room will decrease by the increased quantity immediately after the amended order is entered into the system. If the current foreign room is less than the increased quantity, the system will reject the modified order.

If a Buy order is canceled by the investor or by the system, the current foreign room will increase by the canceled amount.

b) Put-through trading

- The current foreign room will decrease immediately after the put-through order between a foreign buyer and a domestic seller is entered into the system.

- If a foreign investor cancels a put-through Buy order with a domestic seller, the current foreign room will increase immediately after the cancellation order is entered into the system.

- The current foreign room will increase after the settlement if the transaction between a foreign seller and a domestic buyer is made.

- The current foreign room will remain unchanged if the put-through transaction is between two foreign investors.

12. Regulations on blocking intra-session Buy and Sell Orders during periodic call auctions

Investors are prohibited from placing simultaneous buy and sell orders for the same security within a single periodic call auction session, except for orders that were entered into the trading system in the previous session, remained unmatched, and are still valid.

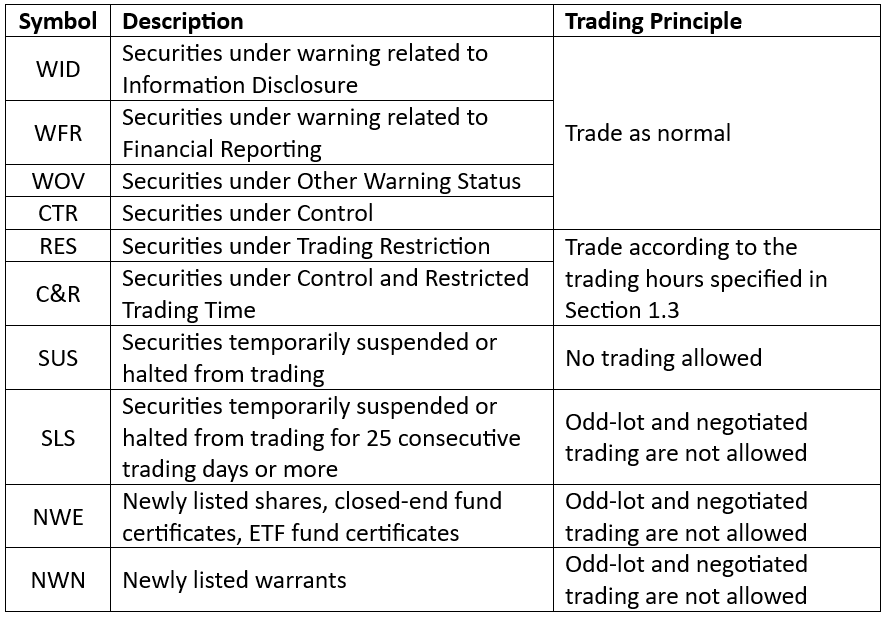

13. Special Stock Status

14. Special trading

- Purchases and sales of treasury stocks and market-making transactions of member companies must be complied with the Circular 120/2020/TT-BTC of the Ministry of Finance.

- Transactions performed by majority shareholders, inside shareholders and related persons must be complied with the Law on Securities and the Circular 96/2020/TT-BTC of the Ministry of Finance.